India Gave a Better Return in Global Market

Every country faces the difficulty of inflation, which is the major cause of the global investment market’s current tightness. Inflation in the US was less than the desired 2% in the 2020s, whereas it was over the desired 4% to 6% in India.

But the noticeable progress in the economic world is India is one of the fastest growing economy in the world. Obviously 2022 has been a turbulent year for investments, but India has outperformed advanced nations in both equities and debt. India has provided a return of 3.8% while the global index has decreased by 16.6%.

The cause of the decrease in return is inflation. Equity generates return and debt offers security in advanced economies, according to the investing principle. A classic Indian portfolio with 60% equity and 40% debt will return on average 5.6% in 2022, with equity contributing 7.2% and debt 3.1%. The compounded return has been an average of 5.9% when gold is included. It did not, however, outrun inflation.

Boost to Equity market

In December monetary policy, the Reserve Bank has projected inflation to come down to 5.4% by second quarter of 2023-24. If conditions go this way, it will give a boost to the equity and bond markets.

Challenges Increased by Increase in Repo Rate

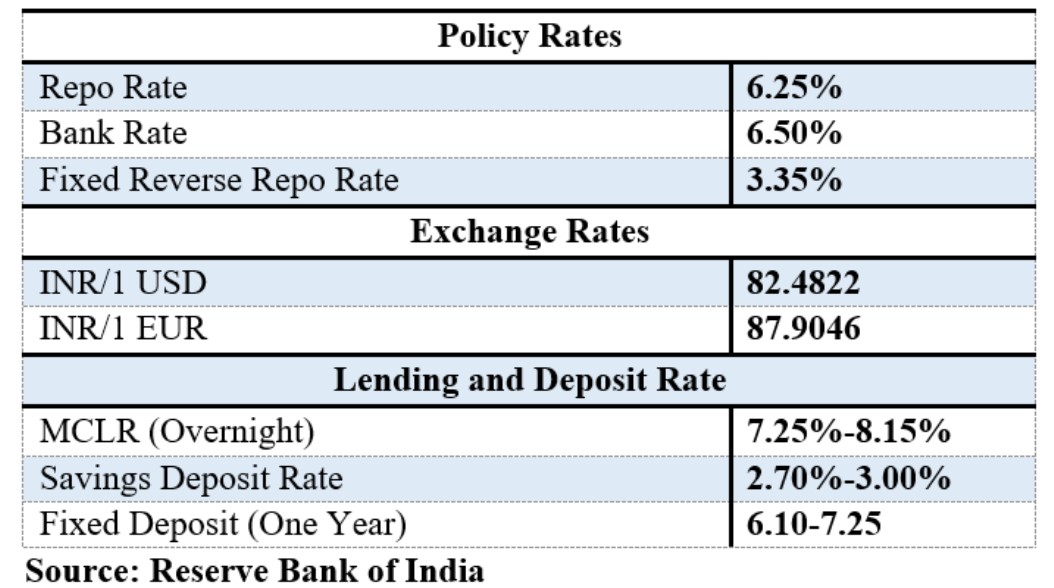

Let’s check on the current rates as at 1:30 PM of December 15, 2022

Recession in 2023? Ouch!

Recession Can Reduce Employment Opportunities in India. The US, China, and the European Union, the three countries that contribute the most to the global GDP, are predicted to experience a recession until 2023. India will see a variety of effects from this circumstance. Exports, which are already under pressure, will suffer from the downturn. India exported 40% of its goods to Europe and North America in 2021–2022. These economies will reduce their reliance on imported raw materials and finished goods since their economies are slow to grow and generate money. Risk-averse international investors can get left behind in this scenario. Urban unemployment is also anticipated to rise as a result of widespread layoffs.

Claimed Possibilities Ahead

There is a chance that the economy may be unstable in 2023 as well. However, novice and retail investors need to remember certain fundamental guidelines. Over time, a diverse portfolio produces steady returns.