Banks Are Increasing Rates According To Repo Rate

Well, the hike in the reserve bank’s Repo Rate has caused the bank’s deposit rates to catch up. Since May of this year, the Reserve Bank has raised the Repo Rate by 2.25%. So that, Deposit rates at HDFC have increased from a low to 2.10% rate highest of three years. A rise in deposit rates has also been announced by prominent private sector banks ICICI Bank, Axis Bank, Kotak Mahindra Bank, and AU Small Finance Bank.

All public and private sector banks have launched a race to raise interest rates on Fixed Deposits (FDs) due to the poor growth of deposits relative to loans. Rates have gone lifted by up-to 1% at SBI and HDFC Bank. Customers are receiving more than 7% interest on FDs as a result. This is done on order to encourage the customers to save more and more in form of Fixed Deposits so that, the functions of money supply remain smooth.

As on November 18, 2022, according to recent Reserve Bank data, bank credit growth was 17.2%. Whereas the deposit rate has increased by 9.6%. Fixed Deposit rates for terms longer than a year were 6.68% in November, 6.25% in October, and 5.70% in September, according to a Bank of Baroda study. SBI has increased FD rates by up to 1% and HDFC Bank by up-to 0.75% after the repo rate hike by Reserve Bank.

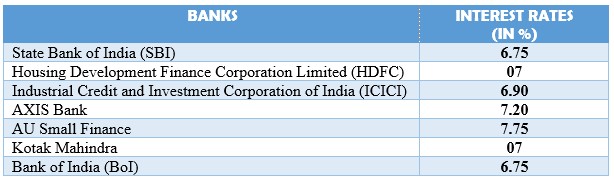

How Much Interest Is Being Paid by Which Bank?

It seems that, if there is different increase in deposit rates by different banks, then the challenges of the banking sector may increase. Following is the list of banks and interest rates paying by them on Fixed Deposits by their respective Customers.

Before Getting Fixed Deposits, Keep In Mind That..

Banks charge a fee while breaking the FD in the middle. Also, interest is given for the same period for which the FD has been standing. This causes loss to the customers. In such a situation, get FD of a small amount and also keep the time period separately. With this, you will always have capital available. Also, if there is a chance of breaking the FD in the middle, then you will not suffer much loss.

As well as, you should keep in mind that, the whole deposit up to five lakh rupees is insured, including savings accounts and other assets like FDs with the bank. It is an advice against opening an FD for more than five lakh rupees in a small or lesser-known bank just for the sake of the high-interest rate. If the bank fails for whatever reason, there will be no risk to you up-to five lakh rupees in such a circumstance.