As we bid adieu to April and welcome May, the financial landscape is poised for some significant adjustments. From revised savings account charges to new norms in mutual fund KYC, here are the top 5 money changes you need to be aware of this month.

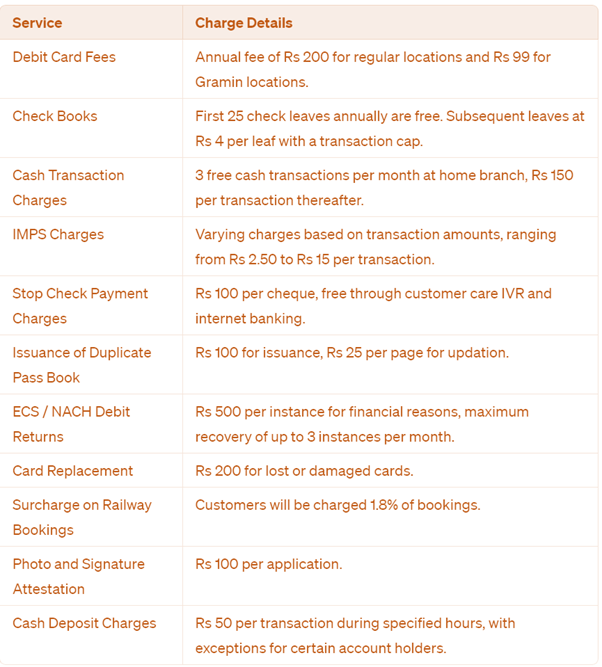

- ICICI Bank’s Revised Charges: ICICI Bank, a stalwart in the banking sector, has announced revisions in various service charges effective May 1. These changes encompass a spectrum of services including ATM usage, debit cards, chequebooks, IMPS, stop payments, and more. Here’s a breakdown:

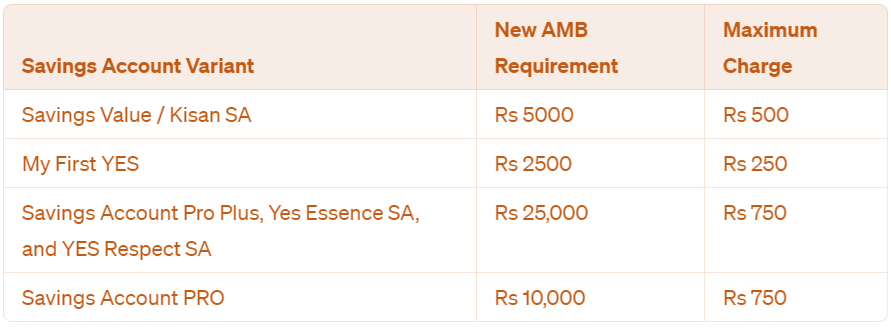

2. Revised Minimum Average Balance (AMB) by Yes Bank: Yes Bank is adjusting its minimum average balance requirements across different savings account variants. The changes are as follows:

Additionally, Yes Bank credit card users will face a 1% surcharge on utility bill payments, with a free usage limit of Rs 15,000 in the billing cycle.

3. Credit Card Surcharge by IDFC First Bank: IDFC First Bank announces a 1% surcharge plus GST on credit card payments exceeding Rs 20,000 for utility bills. Exceptions apply to certain credit card types, but users need to be cautious about exceeding the threshold to avoid additional charges.

4. Mutual Fund KYC Norms: Effective April 30, new KYC norms mandate precise correspondence between the name provided on mutual fund applications and the name on the PAN card. This regulation impacts new investments and underscores the importance of accuracy in documentation.

These changes underscore the dynamic nature of the financial sector. Staying informed is key to navigating these adjustments seamlessly. Whether it’s optimizing your banking preferences or adhering to regulatory requirements, being proactive ensures financial well-being in the face of evolving norms.