Tax System Now and Then

There are currently two taxation regimes. The first system, often known as the old system, exempts income up to ₹ 5 Lakhs from taxation. In addition, there is an exemption from depositing tax on investments up to ₹ 1.5 Lakh under section 80C. it is found that many of the taxpayers in India record a yearly income of less than ₹ 7 Lakh. In Tarun Bajaj’s opinion (Revenue Secretary), the tax structure has to be rethought in order to boost the tax slabs while decreasing the available exemptions. Bajaj thinks that by doing this, a growing number of individuals will be able to participate in the new tax system. If this occurs, it will be simple for the government to elect to keep just one tax system in place rather than two.

On the other hand, GST Council has made some decisions for micro, small and medium-scale industries. The GST Council gave in-principle approval to permitting unregistered suppliers and composition taxpayers to make the intra-state supply of products through e-Commerce Operators (ECO) like Amazon, Myntra, Limeroad, eBay, Snapdeal, Flipkart, etc. in June of this year in order to facilitate e-commerce for small businesses. As of right now, intra-state supply will be permitted starting on October 1, 2023, for E-commerce merchants who offer products with a turnover of up to ₹ 40 Lakh and services with a turnover of up to ₹ 20 Lakh but are unregistered under the Central Goods and Services Tax (CGST) Act. In the media briefing on the findings of its 48th meeting, the council, presided over by finance minister Nirmala Sitharaman, “Authorized the adjustments in the GST Act and GST Rules, together with the issuing of necessary notifications, to allow the same.”

Better Direct Tax and Better Refunds in FY23

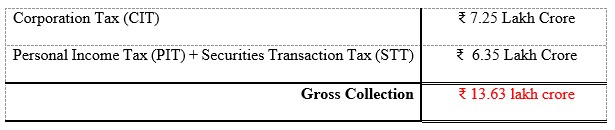

Government income for the fiscal year 2022–23 has proven to be higher because to an increase in India’s gross direct tax receipts of approximately ₹ 13.63 Lakh Crore, or nearly 26%, so far this fiscal year. The Central Board of Direct Taxes (CBDT) stated in a statement on Sunday that the gross direct tax collection for FY23 was ₹ 13.63 Lakh Crore (before accounting for refunds), up from ₹ 10.83 Lakh Crore in the same period of the previous financial year. The Net Direct Tax collection after accounting for refunds is ₹ 11.35 Lakh Crore, up from ₹ 9.47 Lakh Crore during the same period of the last financial year.

Additionally, till December 17, 2022, refunds of roughly ₹ 2.28 Lakh Crore have been granted. This is an increase of 68% over the same time in the previous financial year, which came in at ₹ 1.35 Lakh Crore.

The gross collection of ₹ 13.63 Lakh Crore includes: –

Head-Wise Collection Comprises: –

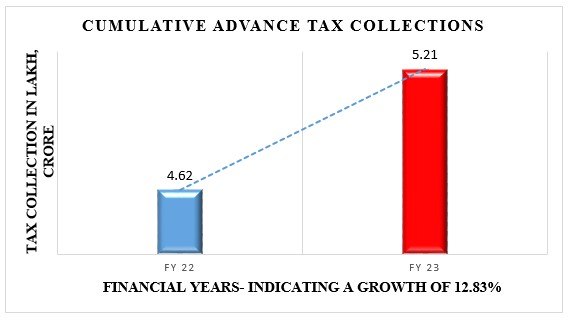

- Advance Tax of ₹ 5.21 Lakh Crore,

- Tax Deducted at Source of ₹ 6.45 Lakh Crore,

- Self-Assessment Tax of ₹ 40 Lakh Crore,

- Regular Assessment Tax of ₹ 46,244 Crore, and

- Tax Under Other Minor Heads of ₹ 11,237 Crore.

The total advance tax receipts for the first, second, and third quarters as on December 17th for the current year are as follows:

According to the CBDT, there has been a noticeable improvement in the processing pace of income tax returns submitted during the current fiscal year, with about 96.5% of the lawfully certified ITRs completed as of December 17, 2022.

The amount of refunds provided in the current fiscal year has increased by over 109% as a result, the statement stated.

Government Can Give Exemption In Tax Rates After Formation Of New Government In 2024!

The budget for the next year will be the last one that covers all expenses until the general elections of 2024. Following this, the government will once again submit the budget in February of 2024, but this time it will just be an interim budget. Following this, the government will once again submit the budget in February of 2024, but this time it will just be an interim budget. A full-time budget will likely be unveiled in July 2024, following the establishment of the next administration. Before the elections, it is anticipated that the administration would be able to make a lot of concessions to the populace. However, the government will put more of its attention toward the budgetary initiatives for which the target year of 2022 has been set, such as doubling farmer income and providing housing for everyone, before making these concessions. The focus of the 2019 budget may first be on the distribution of cash to accomplish these unfinished goals since the government has been delayed in fulfilling them as a result of Corona.

According to Revenue Secretary, this budget would include modifications to tax slabs. However, the previous tax system will not see these adjustments. If these modifications are adopted, they will be included in the new tax structure that will be implemented in 2020. People have not embraced the new tax structure as the administration had hoped, which is the cause of this. In such a scenario, the government may progressively advance on the plan to continue with only one tax system by eliminating the old tax system by enrolling more and more individuals in this new system.

Can Anticipate Change in Tax Slabs in New Tax System

People profit from preparing under the old tax structure, claims Revenue Secretary. However, a lot of individuals must pay taxes and do not have any money for investments. It is also not advantageous for taxpayers in any way because the new tax system already places restrictions on paying taxes because there are no exemptions. According to Bajaj, these inconsistencies are being reviewed, and he expects that the individual who succeeds him as the Revenue Secretary would treat these matters seriously.

Bajaj advises raising the minimum tax bracket of the new tax system from ₹ 2.5 Lakh to ₹ 7 Lakh in order to improve its popularity. A straightforward tax structure must be created for this, and simple math may also be used to determine how big of an impact raising the cap will have on revenue. As a result, the people can receive relief by limiting the tax slabs, and the emphasis can also be placed on boosting revenue collection.

GST Council made things easy for MSMEs by allowing unregistered sellers to make intra-state supply of goods via e-commerce.

Starting in October of next year, e-commerce merchants registered under the GST composition scheme and with a revenue of up to ₹ 1.5 Crore will also be eligible for the GST registration waiver. With reduced tax rates of 2% of turnover for manufacturers, 1% of turnover for dealers, and 5% of revenue for restaurant operations, the plan intends to minimize the compliance cost for small taxpayers. Importantly, in order to encourage MSMEs to adopt e-commerce, a Parliamentary committee report from June of this year on the development and regulation of e-commerce in India advised expanding the GST Composition scheme to online retailers.

The recent judgment in the 48th GST Council Meeting would enable small business owners who do not meet the GST threshold restriction to growing through online sales. There are more than 8 crore small merchants in the nation, but many of them operate their businesses illegally since their yearly sales fall below the GST threshold. These dealers would now be allowed to conduct business online.

There are many rays of hope to be wealthy India in the future, as India is already 5th fastest growing economy in the world and we all are looking forward for the best which yet to come.