Trading stocks entails purchasing and disposing of financial products including stocks, mutual funds, commodities, money, bonds, debentures, etc. A stock and security trader purchases and sells assets with the goal of constructing an investment portfolio. In order to take advantage of price variations, a trader buys and sells stocks and other securities. Equity (delivery, intraday, F&O), commodities, and currency trading are all included in trading income. All other kinds of trading are regarded as business income under income tax laws, however, equities delivery trading is often considered to be an Income from Capital Gains.

Trading income is considered business income

Trading income is considered business income. Business income can be classified as either Speculative Business Income or Non-Speculative Business Income under the Income Tax Act.

- The Income Tax Act defines a Speculative Transaction as a transaction in which the purchase or sale of any commodity, including stocks and shares, is completed without actual delivery. Intraday trading refers to trading in stocks or other securities during the same trading day. It is a speculative business income as a result.

- Non-speculative business income is any revenue generated by a business that is not inherently risky. Therefore, trades in equities F&O, commodity trading, and currency trading are included in this revenue. F&O Trading is non-speculative in nature because it acts as a hedge and delivers the underlying securities. Trading in commodities and currencies throughout the day is explicitly excluded from the definition of speculative transactions. It is a Non-Speculative Business Income as a result.

The deadline for businesses to which the Tax Audit does not apply is July 31. For business owners who are subject to a tax audit, the deadline is October 31.

Determine tax obligation If both stock trading and F&O trading have generated gains for Trader

1) Trading in equity generates capital gains income. 10% of LTCG revenue over INR 1 lakh is subject to tax. The STCG income tax rate is based on slab rates.

2) Equity intraday trading is taxed at slab rates as a speculative business income.

3) Trading in futures and options is taxed at slab rates as Non-Speculative Business Income.

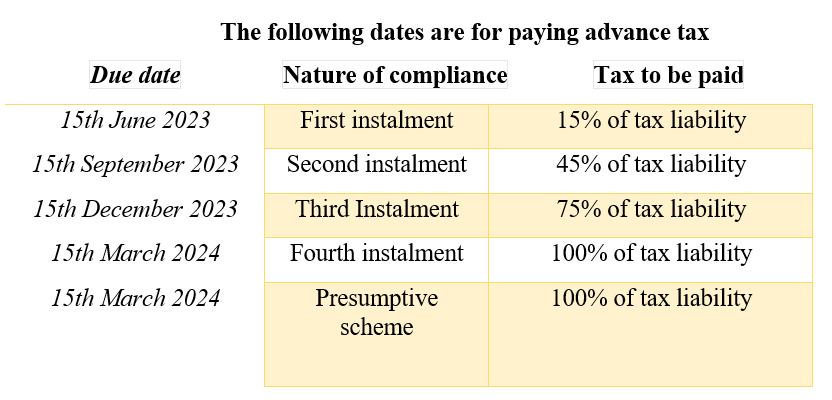

Liability to pay advance tax

The Income Tax Act mandates that an assesses who has a total tax liability of more than Rs. 10,000 pay advance tax. Therefore, if a dealer owes more than Rs. 10,000 in total income taxes, they must pay advance tax throughout the course of the financial year in 4 payments.

Important dates for the payment of advance tax installments for the fiscal years 2023–24

Every time we discuss income tax, there are certain tax procedures that must be performed by the deadlines given, such as completing income tax forms and promptly paying advance tax, among other things.

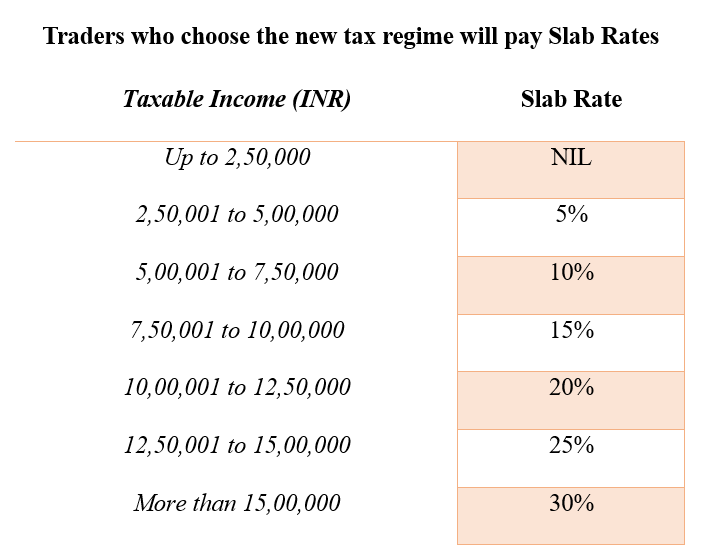

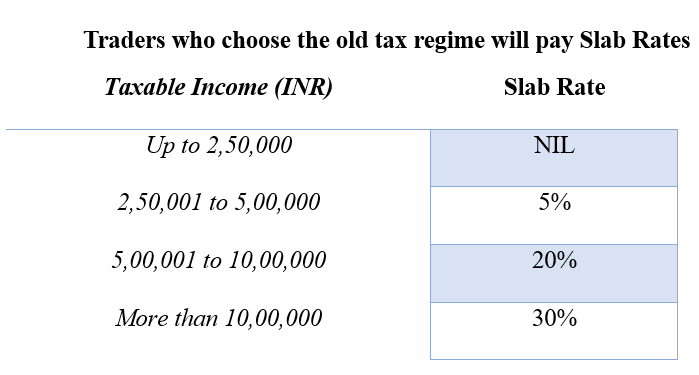

Income Tax Rates of Trading Income

According to the Income Tax Act, business income is taxed at slab rates. The slab rates for both the old and new tax regimes are listed below.

Note: Surcharge is liable for the total income as per the prescribed surcharge slab rate, a Cess is liable at 4% on (basic tax + surcharge)

Note: Surcharge is liable for the total income as per the prescribed surcharge slab rate, a Cess is liable at 4% on (basic tax + surcharge)