The Indian stock market has been buzzing with activity lately, with small and mid-cap stocks outshining the broader indices like Sensex and Nifty. Over the past few weeks, these stocks have seen significant gains, making them the center of attention for investors. Here’s an in-depth look into this rally, its causes, and the market’s current state.

Key Highlights of the Recent Market Rally

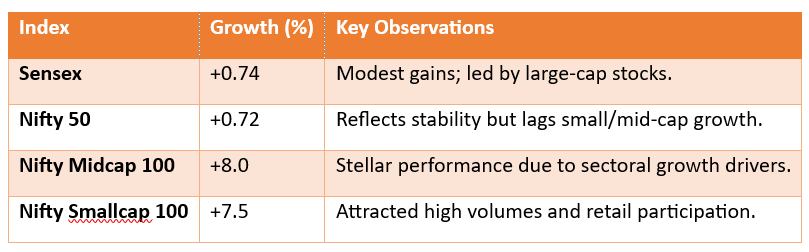

- Small and Mid-Cap Performance: The Nifty Midcap 100 index surged by 8%, while the Nifty Smallcap 100 index rose by 7.5%. This outperformance contrasts sharply with the relatively moderate growth of large-cap indices like Sensex and Nifty.

- Benchmark Indices:

- Sensex: Gained 598 points (+0.74%), closing at 66,665.

- Nifty 50: Rose by 194 points (+0.72%), ending at 19,948.

- Nifty 50 Next: Witnessed a 4% increase, showcasing its growing appeal.

- Investor Sentiment: Renewed interest in small and mid-cap companies has been driven by expectations of higher returns and diversification opportunities.

Factors Driving the Surge

- Favorable Valuations: The correction in valuations during market dips provided an attractive entry point for investors. Small and mid-cap stocks, which were undervalued, became the focus of institutional and retail investors alike.

- Economic Stability: India’s robust economic performance and stable macroeconomic indicators have played a significant role in boosting investor confidence.

- Government Policies: Policy reforms aimed at strengthening the small and mid-sized enterprise (SME) sector have created a conducive environment for growth.

Performance Comparison: Large vs. Small & Mid-Cap Stocks

Investor Trends and Market Outlook

- Increased Participation: Retail investors are showing a growing preference for small and mid-cap stocks due to their potential for higher returns. Meanwhile, institutional investors are focusing on diversification by allocating funds to these indices.

Future Projections:

- Analysts expect continued momentum in these segments, particularly in industries like IT, infrastructure, and manufacturing.

- However, investors are advised to remain cautious as valuations have started to rise sharply.

The rally in small and mid-cap stocks signifies a shift in market dynamics, reflecting the growing confidence of investors in India’s broader economic story. While these stocks present lucrative opportunities, it is essential to approach them with a well-researched strategy to navigate potential risks.

As the markets evolve, staying informed and agile will be crucial for investors aiming to capitalize on emerging trends.