India’s capital markets are buzzing with activity as over 75 companies are preparing to raise an impressive ₹1.5 lakh crore through Initial Public Offerings (IPOs). The upcoming surge marks a significant fundraising effort and highlights the continued interest of companies seeking to go public, despite fluctuating economic conditions.

The Current Scenario: Companies and Fundraising Activity

According to data compiled from Primedatabase.com, 75 companies have laid out plans for raising over ₹1.5 lakh crore. This impressive figure speaks to the growing confidence in India’s capital markets, despite global economic uncertainties.

Out of these companies:

- 22 companies have already received approval from the Securities and Exchange Board of India (Sebi) and are set to raise a collective ₹60,000 crore.

- 53 companies are awaiting Sebi’s approval for raising an additional ₹95,000 crore.

Such high-value IPO activities underscore the trust businesses place in the Indian stock market to meet their capital requirements and growth strategies.

Recent IPO Successes

The trend isn’t a new phenomenon either. In 2024 alone, 62 companies successfully raised over ₹64,000 crore through IPOs. This marked the highest fundraising activity seen in the last three years, showing that Indian markets have been an attractive destination for companies looking to raise capital.

Top 5 IPOs Awaiting Sebi Approval

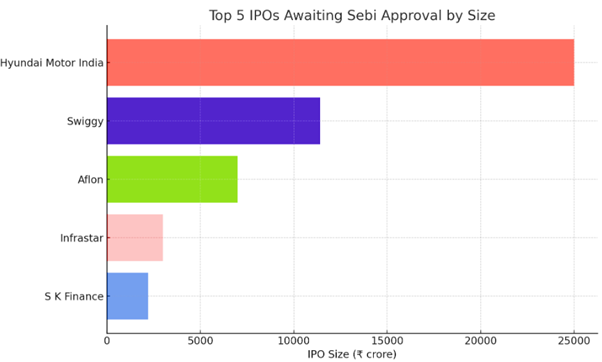

Let’s take a closer look at the top five IPOs in the pipeline, based on the size of funds they aim to raise:

- Hyundai Motor India: ₹25,000 crore

- Swiggy: ₹11,400 crore

- Aflon: ₹7,000 crore

- Infrastar: ₹3,000 crore

- S K Finance: ₹2,200 crore

These companies span different sectors, from automotive to food delivery and financial services, further demonstrating the diverse industrial appetite for capital in India.

As seen in the bar graph, Hyundai Motor India leads with the largest IPO size of ₹25,000 crore, followed by Swiggy at ₹11,400 crore. The diversity in IPO sizes highlights the breadth of the companies preparing to enter the public market.

Why Is This Surge in IPOs Significant?

The planned IPOs are significant for several reasons:

- Economic Boost: These public offerings will infuse a large amount of liquidity into the market, encouraging investment and consumption.

- Diversification: Companies from different sectors, such as tech, auto, and financial services, represent a wide variety of industries benefiting from investor interest.

- Investor Confidence: The success of recent IPOs and high-profile approvals from Sebi suggest strong investor confidence in India’s growth prospects.

Conclusion: A Promising IPO Landscape

With over ₹1.5 lakh crore waiting to be raised, India’s IPO market is witnessing one of its most vibrant phases. The variety of industries seeking public investment signals not only the strength of the market but also the confidence that companies have in their growth and expansion plans. For investors, these upcoming IPOs offer opportunities to participate in India’s growth story across a wide range of sectors.

Whether you are a seasoned investor or a novice looking to explore the equity markets, the IPO wave presents a great chance to evaluate and potentially invest in some of the country’s leading enterprises. Stay tuned, as the next few months are sure to bring plenty of action on the IPO front!