The past month’s investment pattern in mutual funds that invest in stocks, i.e. equities, was intriguing. The majority of investments were made by small-cap funds. Large-cap funds, on the other hand, saw the most withdrawals. As a result, investment in all types of equity funds fell in July compared to June.

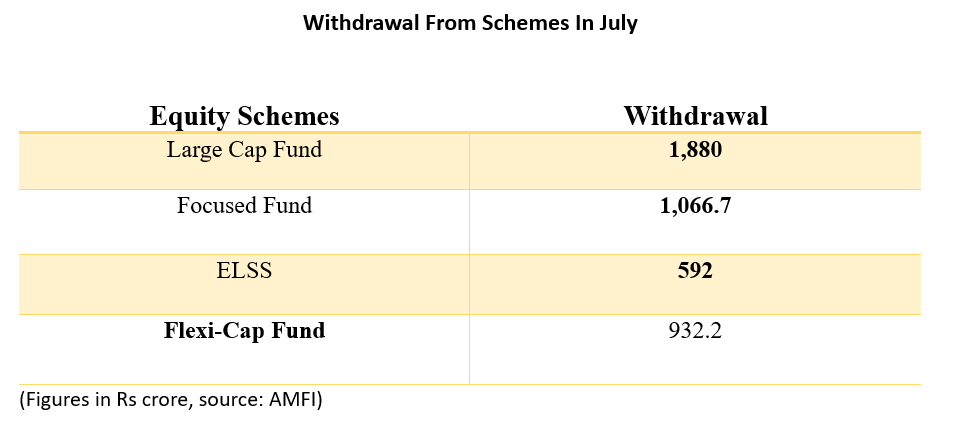

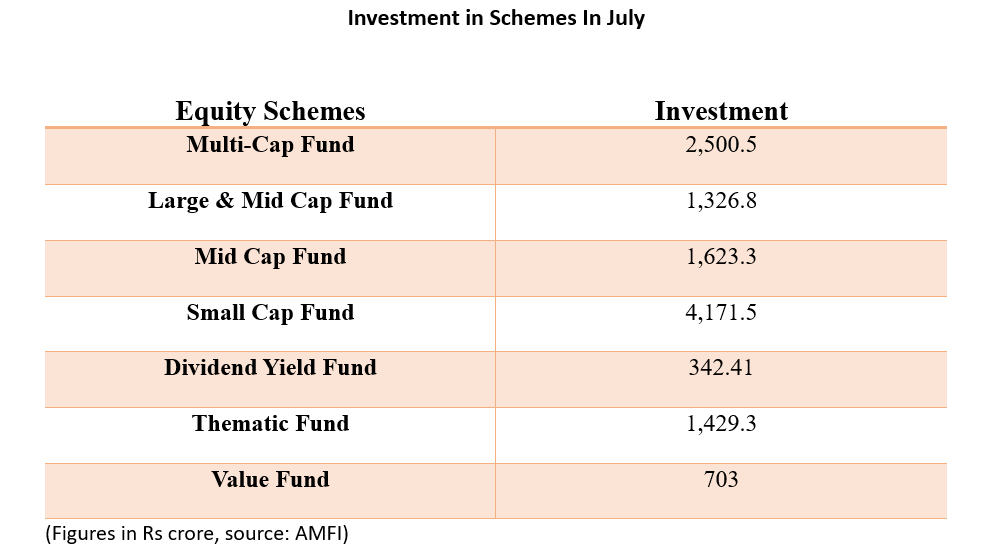

In July, equity funds collected Rs 7,626 crore, up from Rs 8,637.50 crore in June. Except for big-size, targeted, ELSS, and flexi-cap funds, most equity funds witnessed higher inflows than withdrawals during this period. In reality, investors were drawn to small-size funds due to their superior performance. As a result, small-cap funds received 54.7% of total equity fund investment last month. According to statistics provided on Wednesday by the ‘Association of Mutual Funds in India’ (AMFI), the biggest net investment of Rs 4,171.44 crore was made in small-cap funds in July.

In July, inflows into multi-cap funds more than quadrupled to Rs 2,500.5 crore from Rs 735 crore in June, while SIP investments surpassed Rs 15,000 crore for the first time. It has been steadily rising since 2021.