The process of lowering the inflation rate has advanced. This rate is now only 6%. Compared to 6.77% in October, the current month’s inflation rate is 5.88%.

The latest inflation numbers for the month show that inflation in rural areas is still higher than in urban ones. The Consumer Food Price Index, which measures the inflation of food goods, was 4.67% of the overall inflation rate. This rate was 1.87% at the same time this month last year. Food inflation in rural regions is 5.22%, but it is 3.69% in urban areas. In comparison to previous year, food inflation was 1.87% over the same period. Previously, it was 1.09% in rural regions and 3.33% in urban areas.

Consumer Price Index

Consumers seldom make large purchases. They purchase products at the retail market. The variation in related prices as determined by the Consumer Inflation Rate (CIR). The key indicator for determining monetary and credit-related policy, according to the Reserve Bank of India, is the CPI rather than wholesale prices.

Wholesale Price Index

The Wholesale Price Index (WPI) is used to calculate the country’s inflation rate. The average price level of items traded in the wholesale market is tracked using this index. Through WPI, more than 400 commodities are tracked and evaluated.

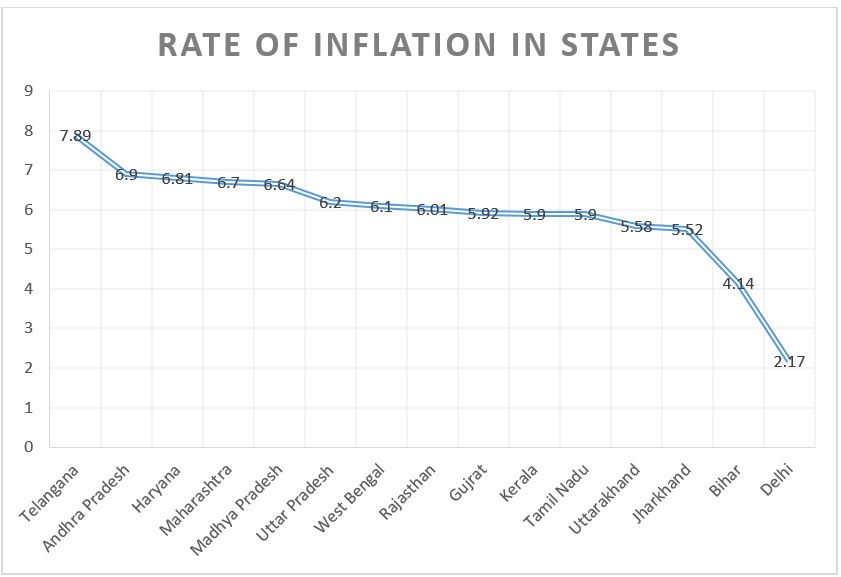

11 States of The Country Are More Expensive Than The National Average

On the subject of inflation, 11 Indian states have prices that are higher than the country as a whole. The data shows that Telangana has the highest inflation rate in the nation, with Andhra Pradesh, Haryana, Maharashtra, Madhya Pradesh, Uttar Pradesh, West Bengal, Rajasthan, Gujrat, Kerala, Tamil Nadu, Uttrakhand, Jharkhand, Bihar, and Delhi following in decreasing order.

Possible relief for common people

According to some analysts, the general people is directly impacted by the low rate of retail inflation. As a result, things like oil, pulses, and other needs start to become more affordable. It eases the financial strain on the general populace. Any nation’s economy would benefit from this, according to experts.