The Governor of the Reserve Bank of India (RBI), Shaktikanta Das, recently expressed concerns regarding the increasing dependence on Artificial Intelligence (AI) and Machine Learning (ML) in the financial sector. He emphasized that while AI-based solutions have the potential to improve financial operations, an over-reliance on them poses significant risks.

In this blog, we will explore the insights provided by the RBI Governor and understand how the dependence on AI can affect financial stability. We will also discuss ways to strike a balance between leveraging AI and maintaining robust governance frameworks.

Key Risks of Excessive AI Dependence

- Systemic Vulnerabilities

According to the RBI Governor, the financial system becomes increasingly vulnerable if key operational processes are managed solely by AI-based technologies. Even minor disruptions in these algorithms could trigger larger financial system risks.

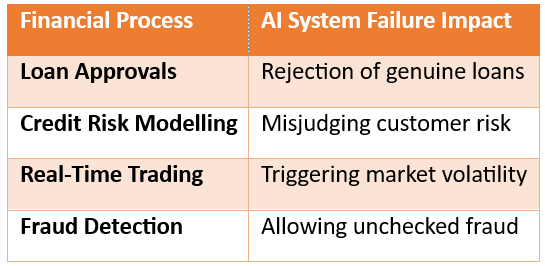

Potential Risk Areas:

- Automated credit scoring models failing during unpredictable market conditions.

- AI-powered lending tools rejecting genuine credit applications based on faulty data.

- System failures affecting stock market operations reliant on algorithms.

Potential AI Failure Points in Financial Processes

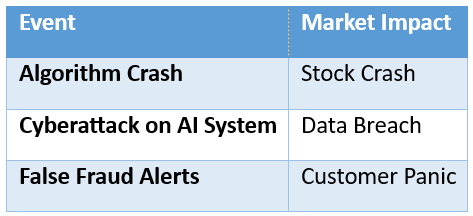

- Impact on Financial Stability

Das highlighted that the improper functioning of AI systems can disrupt the financial ecosystem. For instance:

- Issues in liquidity management algorithms could affect financial markets.

- Poor AI governance might create risks across interconnected institutions.

Effect of AI Failures on Financial Markets

- Cybersecurity Threats

Increasing AI usage opens up new avenues for cyber-attacks and data theft. Financial institutions with heavy AI dependency may find it difficult to recover from cyber breaches, leading to compromised data integrity.

Real-World Concerns:

- Ransomware Attacks: Hackers may target AI-driven systems to halt operations.

- Data Leaks: Sensitive financial data used by AI models can be exposed.

- Model Exploitation: AI algorithms can be manipulated by adversaries, leading to fraudulent activities.

Mitigating the Risks: RBI’s Recommendations

To address these risks, the RBI emphasizes the following measures:

- Building Resilient Systems: AI systems must have backup mechanisms to ensure continuity during failures.

- Human Oversight: AI should complement human decision-making, not replace it entirely.

- Cybersecurity Investments: Financial institutions should increase investments in cybersecurity to protect their AI-based solutions.

- Regulatory Frameworks: A well-defined regulatory framework should govern the use of AI in finance to prevent misuse.

The insights shared by the RBI Governor underline the need for caution in adopting AI across financial sectors. While AI has the potential to revolutionize banking and finance, it is crucial to strike a balance between innovation and stability. Financial institutions must not only leverage AI’s potential but also ensure strong governance, adequate human oversight, and stringent cybersecurity measures.

Call to Action:

To stay ahead of potential disruptions, financial institutions must regularly audit their AI systems and adopt proactive governance frameworks. As customers, it’s equally important to stay informed about how AI is being used in your financial products.