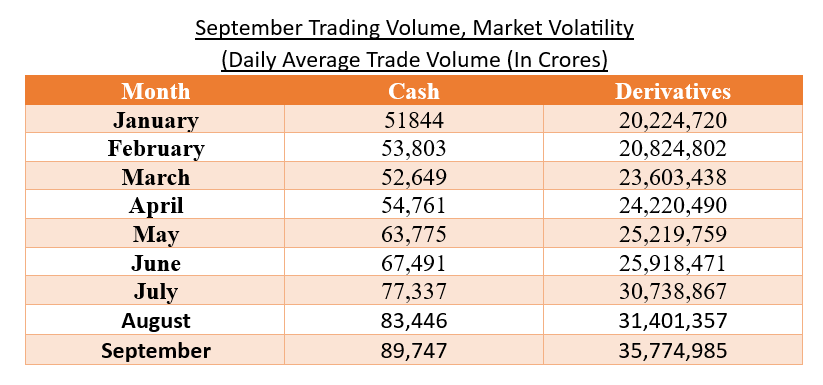

In September, equity market activity, including cash and derivatives, hit new highs as increased volatility provided investors with fertile trading grounds. The average daily traded volume (ADTV) in the cash category, which includes both the NSE and the BSE, was Rs 89,747 crore. This exceeded the previous high of Rs 88,621 crore in February 2021.

Meanwhile, in the futures market, ADTV rose for the 11th consecutive month, reaching a new all-time high of Rs 357.7 lakh crore on both the NSE and the BSE combined. This was a 14% rise over the previous month and a tripling of growth over the previous year. The BSE futures segment increased thrice from the previous month to Rs 26.4 lakh Crore. Its market share was 7.3%. BSE has a 6.92% market share in the cash category.

In September, the benchmark NSE Nifty 50 increased by 967 points, or 4.8%. This was the most significant change in the previous six months. On September 15th, the index achieved an all-time high of 20,192 before suffering minor dips.

After finishing in the green for the first 11 trading days of the month, the S&P BSE Sensex reached a record high of 67,839 as well. Aside from that, wider markets such as the Nifty Midcap 100 and Nifty Smallcap 100 hit fresh highs. Experts ascribed the increase in trading volumes to favorable market conditions and a jump in IPOs.

( Above Table is of 2023)