In recent years, there has been a significant shift in the investment behavior of the youth in India. The traditional allure of bank deposits seems to be waning, with younger generations increasingly gravitating towards more lucrative investment avenues like the stock market and mutual funds. This trend, supported by data from a recent State Bank of India (SBI) report, highlights a growing disillusionment with the modest returns offered by bank deposits, especially when compared to the potential gains from other investment options.

Elderly Dominance in Bank Deposits

According to the SBI report, a staggering 47% of the total deposits in banks are held by the elderly. This indicates a stark contrast in the investment preferences between the older and younger generations. The youth, instead of parking their savings in low-yield bank deposits, are exploring other investment options that promise better returns.

The Youth’s Attraction to Stock Markets and Mutual Funds

The report underscores that the average age of stock market investors is just 32 years, with a significant 40 percent of investors being under 30 years of age. This youthful demographic is increasingly aware of the potential returns that can be garnered from investing in the stock market and mutual funds.

The data tells a compelling story:

In just a decade, mutual fund investments have seen nearly a five-fold increase, reflecting the growing confidence among investors in these financial instruments.

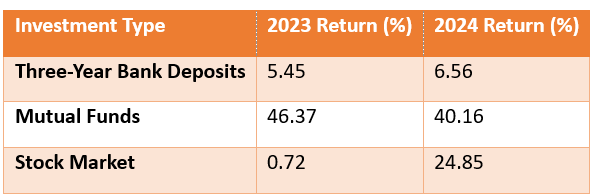

Comparative Returns: Bank Deposits vs. Mutual Funds vs. Stock Market

Investors tend to follow the money, and the data on returns clearly indicates why the youth are moving away from traditional bank deposits. In the financial year 2023, the interest on bank deposit schemes (for a period of three years) was a mere 5.45%. In contrast, mutual funds delivered a robust overall return of 46.37%, while direct investments in shares yielded a modest 0.72%. However, by 2024, the scenario had shifted:

The improved performance of the stock market in 2024, delivering a 24.85% return, along with the still-impressive 40.16% return on mutual funds, makes a compelling case for the youth to divert their investments from bank deposits to these higher-yielding options.

The Deposit and Loan Growth Cycle

The disparity between deposits and loans is not a new phenomenon. Since the financial year 2022, the total deposit amount in government banks has surged by Rs 61 lakh crore, while the loan disbursement amount has grown by Rs 59 lakh crore. Over the past decade, deposits have increased by 2.75 times, and loans by 2.8 times. This cyclical pattern is expected to continue, with the current phase projected to conclude by June-October 2025.

A Rebuttal to Concerns on Banking Sector Growth

The SBI report also addresses the concerns raised by Finance Minister Nirmala Sitharaman and the RBI Governor regarding the slowing growth rate of deposits in the banking sector, contrasted with the rapid pace of loan disbursement. Contrary to these concerns, the report highlights that the growth rate of deposits and loans in the financial year 2023 was the highest since 1951-52. During this period, total deposits increased by Rs 15.7 lakh crore, while loan expansion reached Rs 17.8 lakh crore.

The Role of Small Deposits in Banking

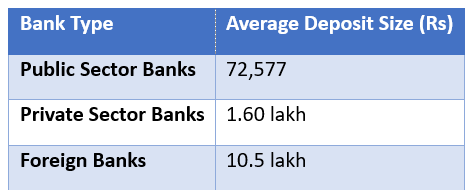

The report also sheds light on the average size of deposits across different banking sectors:

This data underscores the reliance of public sector banks on small deposits, while private and foreign banks attract larger deposits.

The shift in investment preferences among the youth is a clear indication of the changing dynamics in the financial landscape. With the stock market and mutual funds offering significantly higher returns compared to traditional bank deposits, it is likely that this trend will continue. As the youth seek to maximize their financial gains, banks may need to rethink their strategies to attract this demographic and remain competitive in an increasingly diverse investment market.