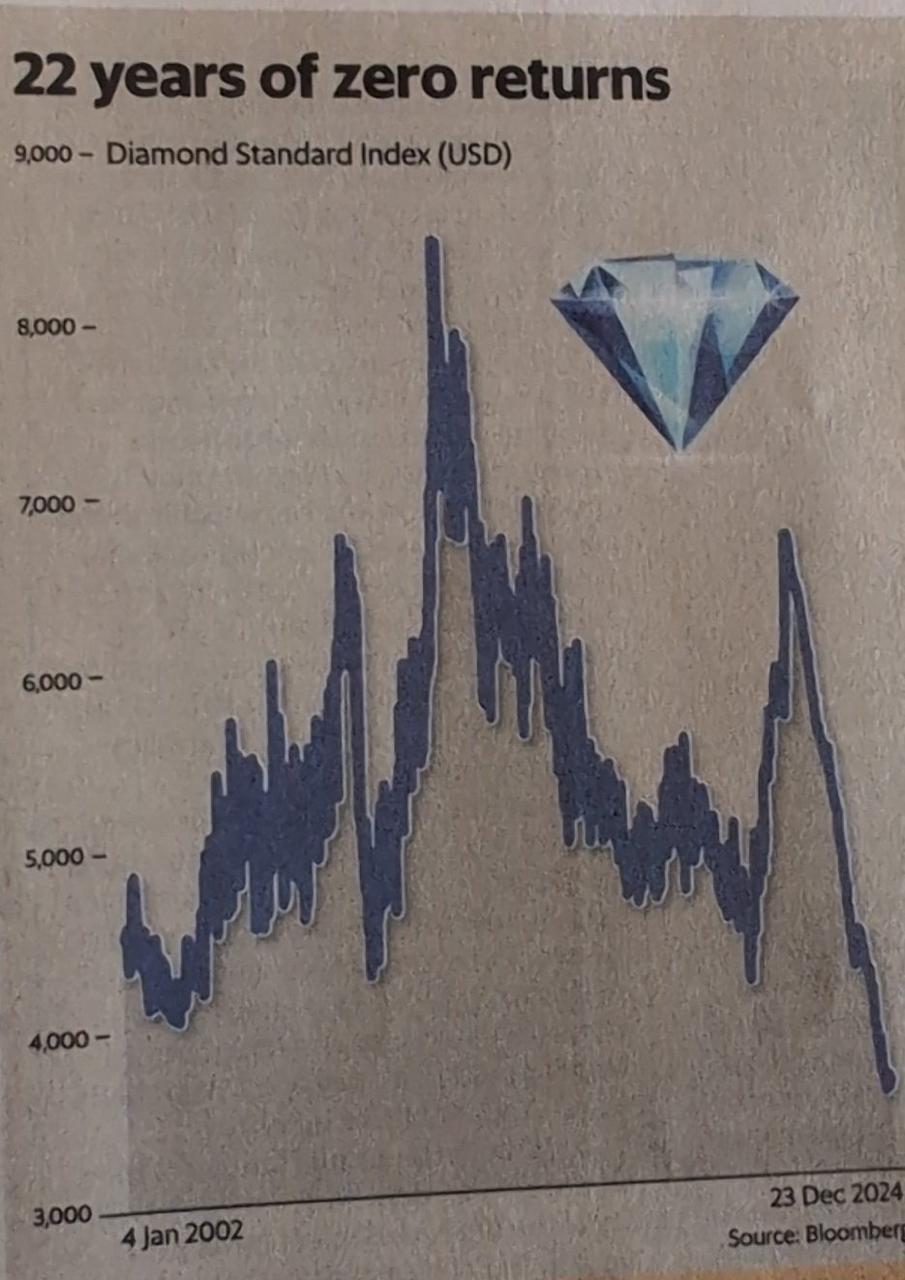

For decades, diamonds have symbolized luxury, love, and status. However, the glittering façade of natural diamonds seems to be losing its shine, especially when evaluated as an investment. Over a 20-year holding period, diamonds are now showing negative returns, a stark reality that many investors and buyers are just beginning to realize.

The Rise of Lab-Grown Diamonds

One of the primary reasons for the downward trend in natural diamond prices is the growing acceptance of lab-grown diamonds (LGDs). These diamonds are chemically, physically, and optically identical to their natural counterparts but are created in controlled environments rather than mined from the Earth.

Lab-grown diamonds offer several advantages that are reshaping the diamond market:

- Affordability: They are priced 30-50% lower than natural diamonds, making luxury more accessible.

- Sustainability: Lab-grown diamonds have a significantly lower environmental impact, appealing to eco-conscious consumers.

- Transparency: Ethical concerns surrounding conflict diamonds (blood diamonds) are largely eliminated with LGDs.

Why Are Natural Diamonds Losing Value?

Contrary to the narrative promoted by traditional jewelers, natural diamonds are not rare. In fact, diamond mining companies have long controlled supply to maintain high prices. With the advent of lab-grown diamonds, this artificial scarcity is being challenged.

Key factors driving the decline in natural diamond prices include:

- Competition from Lab-Grown Diamonds: The identical properties of LGDs are convincing more consumers to choose them over natural diamonds.

- Changing Consumer Preferences: Millennials and Gen Z prefer sustainable and cost-effective alternatives.

- Lack of Investment Viability: Unlike gold or other precious commodities, diamonds lack standardized pricing, making resale difficult and often unprofitable.

The Investment Perspective

Historically, diamonds were marketed as “forever” assets, but the numbers tell a different story. Over the past two decades, natural diamonds have not only failed to appreciate but have also delivered negative real returns. This trend is likely to continue as lab-grown diamonds gain mainstream acceptance and further disrupt the market.

What Should Buyers Know?

If you’re considering purchasing a diamond:

- Reevaluate the Purpose: If it’s for emotional value, lab-grown diamonds offer the same sparkle without the hefty price tag.

- Avoid Falling for Myths: Jewelers often claim natural diamonds are more valuable due to their origin, but the truth is, lab-grown diamonds are indistinguishable to the naked eye or even under magnification.

- Think Sustainability: Lab-grown diamonds align with global efforts for ethical and sustainable consumption.

Conclusion

As the diamond industry evolves, natural diamonds are no longer the unchallenged status symbols they once were. With lab-grown diamonds offering an ethical, affordable, and sustainable alternative, the natural diamond market is facing a steep decline.

For those seeking long-term investments, it’s time to look beyond natural diamonds. Whether you’re buying for love or luxury, the diamond you choose can now truly reflect your values—without compromising on brilliance.

Shine smarter, choose better, and redefine timeless beauty with lab-grown diamonds.