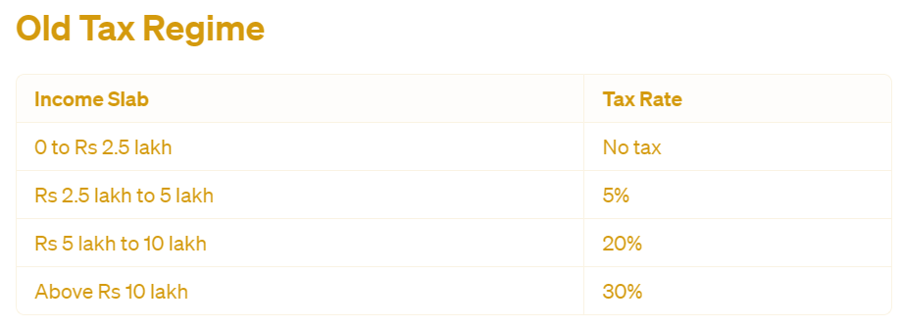

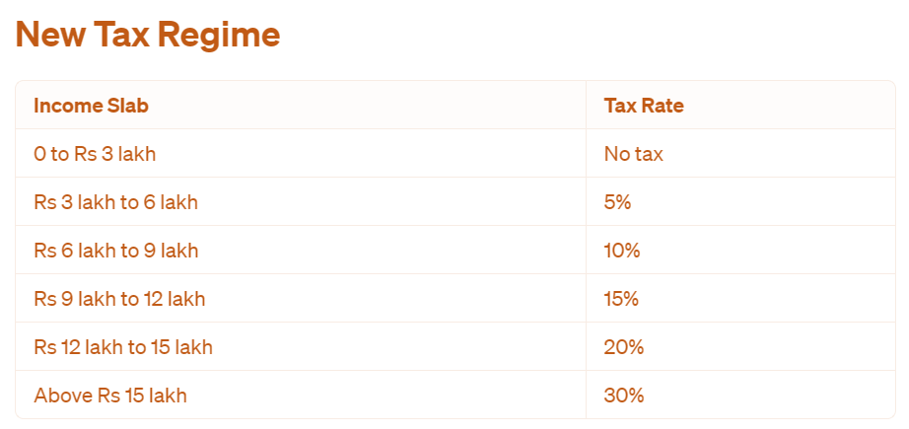

The announcement from the Finance Ministry regarding the income tax regime for the fiscal year 2024-25 has stirred considerable interest and debate among taxpayers. Amidst speculations and misinformation, it’s crucial to understand the nuances of both the old and new tax systems to make informed decisions. Let’s delve into the details with a comparative analysis.

Pros:

- Allows various deductions and exemptions under Sections 80C, 80D, HRA, and LTA.

- Provides flexibility with a range of tax-saving instruments.

Cons:

- Complex structure with higher tax brackets.

- Requires careful planning to optimize deductions.

Pros:

- Lower tax rates across income slabs.

- Simplified filing process with fewer deductions.

Cons:

- Eliminates most deductions and exemptions.

- May not be advantageous for individuals with higher incomes and significant investments.

Considerations for Choosing the Regime

Total Income: Individuals with income up to Rs. 7.5 lakh benefit from exemptions under Section 87A and the standard deduction of Rs 50,000 in the old system.

Deductions and Exemptions: Evaluate your eligibility for deductions under Sections 80C, 80D, HRA, and LTA. Compare the tax benefits with the lower rates in the new system.

Investment Portfolio: The old system allows for tax-saving investments like PPF, NPS contributions, and ELSS mutual funds. Consider your investment strategy before choosing a regime.

Medical Expenses: If you have substantial medical expenses, the deduction under Section 80D is crucial. Assess the impact of limited deductions in the new regime.

Choosing between the old and new income tax regimes requires careful consideration of individual financial circumstances and objectives. While the new system offers simplicity and lower tax rates, it may not be suitable for everyone, especially those with higher incomes and specific investment preferences. Ultimately, taxpayers should weigh the pros and cons to make an informed decision aligned with their financial goals.