The Reserve Bank of India (RBI) Governor Shaktikanta Das is set to conclude the three-day Monetary Policy Committee (MPC) review meeting today amid widespread expectations of a continued status quo on short-term lending rates. As retail inflation persists near the higher end of the central bank’s comfort zone, it is anticipated that the RBI will opt to leave rates unchanged.

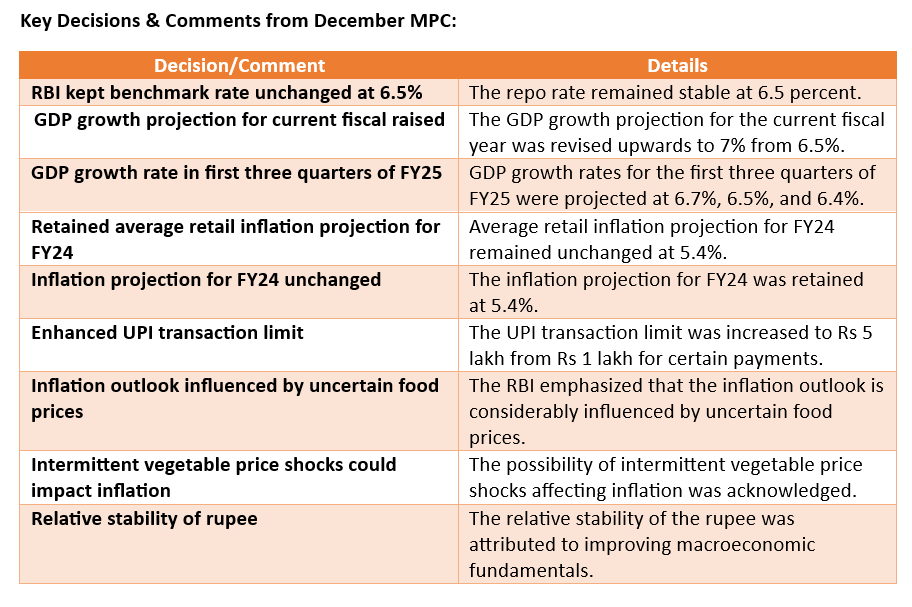

For nearly a year, the RBI has maintained stability in the short-term lending rate, or repo rate, at 6.5%. This decision was last adjusted in February 2023, when the benchmark interest rate was raised to 6.5% from 6.25% in response to inflationary pressures primarily influenced by global developments.

Governor Das is scheduled to deliver the policy speech at 10:00 a.m., followed by a media briefing around noon, providing valuable insights into the committee’s decision-making process and the rationale behind their actions.

Key Expectations:

In line with the sentiments echoed by most economists and as indicated by the State Bank of India (SBI) report, the prevailing expectation is for the RBI to maintain the status quo, holding rates steady at 6.5%.

However, there are voices among economists suggesting the possibility of the RBI shifting its stance from ‘withdrawal of accommodation’ to ‘neutral’.

Some economists have also highlighted the potential impact of a ‘fiscally prudent interim budget’ and indications of global monetary easing, which could prompt the central bank to tweak its stance on tight liquidity.

Government want to wrong practices i.e. Education fees and healthcare charges should be increase.

As per normal person education and healthcare charges should be decrease.