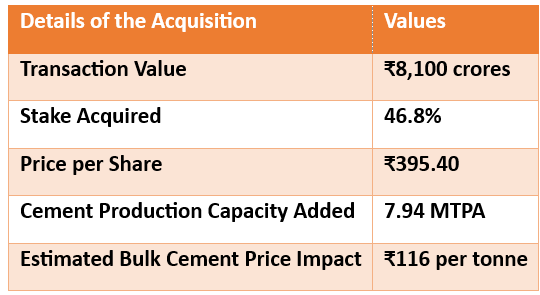

In a significant development within the cement industry, Adani Group has announced its third major acquisition of the year by purchasing a 46.8% stake in Orient Cement. The deal, valued at ₹8,100 crores, further strengthens Adani’s footprint in the cement sector, showcasing the company’s aggressive expansion strategy.

Overview of the Deal

Orient Cement, a well-known entity in the Indian market, will now transfer a large part of its ownership to the Adani Group. Adani will acquire 26% shares of the company at a rate of ₹395.40 per share through an open offer. The remainder of the 46.8% stake will come from other shareholders. This acquisition aims to provide Adani with access to 7.94 million tonnes per annum (MTPA) of cement production capacity—substantially increasing the group’s capabilities and market share.

The Adani Group’s cement division already houses significant acquisitions, and the deal with Orient Cement marks another step in its bid to dominate the sector.

Why Adani Chose Orient Cement?

Orient Cement has built a reputation for efficient operations, with units spread across several states in India. The acquisition provides the Adani Group with increased capacity to cater to the rising demand for cement, particularly in the infrastructure and real estate sectors. This deal aligns with Adani’s strategy to become a major player in India’s cement market, a sector it views as vital to its long-term infrastructure development plans.

Orient Cement operates with significant market presence in the South and Central regions of India, offering ready access to key markets. Additionally, Orient’s production efficiency and scale align with Adani’s goals of reducing production costs while expanding its product offerings.

Strategic Impact on the Cement Industry

The Indian cement sector is witnessing consolidation, with large conglomerates like Adani and Ambuja taking over smaller or mid-sized cement firms. Cement companies are vying for market dominance, especially amid the country’s rapid urbanization and infrastructure development.

This acquisition places the Adani Group in a stronger position to compete with industry leaders like UltraTech and Shree Cement. In fact, experts suggest that post-acquisition, Adani’s total production capacity will rise significantly, helping it take advantage of upcoming government-led infrastructure projects.

Future Outlook

With this acquisition, Adani aims to streamline the operations of its cement division and enhance production output to nearly 7.94 million tonnes per annum. Given the economies of scale and increased supply chain efficiencies, the Adani Group is well-positioned to benefit from the rising demand for cement across India.

Additionally, industry analysts predict that the Adani Group will implement strategic pricing, potentially lowering cement costs, to secure market dominance. The bulk cement rate, currently projected at ₹116 per tonne, could play a crucial role in influencing consumer behavior and ensuring Adani’s competitive edge.

Adani Group’s Cement Acquisition Spree in 2024

This acquisition marks the third takeover in 2024 by the Adani Group, underscoring its aggressive growth strategy. Adani is not only focused on cement production but also looking to integrate its operations across various sectors like infrastructure, energy, and logistics, ensuring sustainable growth for the group in the coming years.

Analysts view this deal as an indication of Adani Group’s long-term plans to emerge as a leading force in the cement industry, as it consolidates and streamlines its businesses. With new production units coming online, Adani is set to expand its footprint even further by 2028, with a total installed capacity expected to reach 14-15 MTPA.

The acquisition of Orient Cement is a landmark deal for the Adani Group. With a massive ₹8,100 crore transaction, the group continues its aggressive expansion in the Indian cement market. This acquisition not only boosts Adani’s production capacity but also helps the conglomerate position itself favorably amidst India’s ongoing infrastructure boom.

Industry experts believe that the cement market will witness further consolidation, and players with deep financial resources like Adani are poised to benefit the most. With its eyes set on becoming a dominant cement player, Adani Group’s latest acquisition might well be a game-changer for the industry.

This deal exemplifies Adani’s ambition to diversify its portfolio across multiple sectors and reflects the increasing importance of strategic mergers in building long-term business resilience in India’s competitive markets. With such bold moves, the Adani Group is cementing its position—not just literally, but also figuratively—in the country’s industrial landscape.