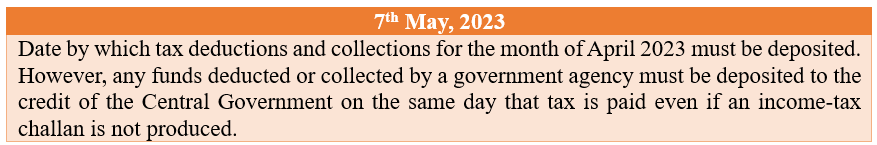

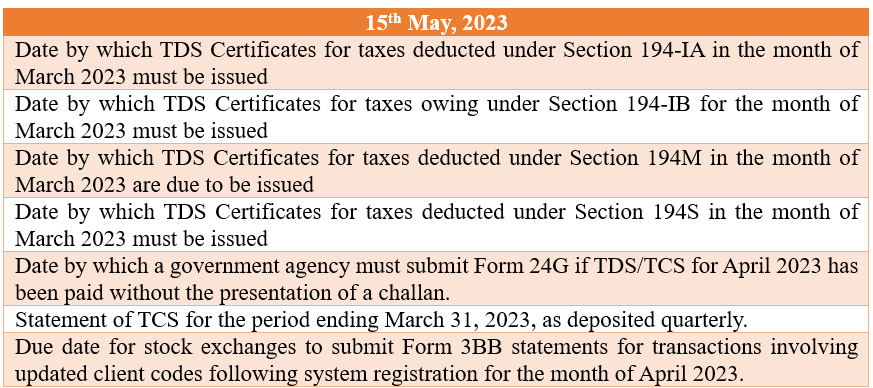

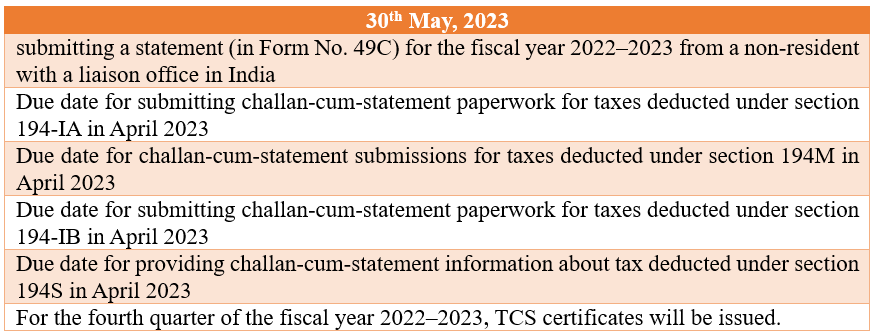

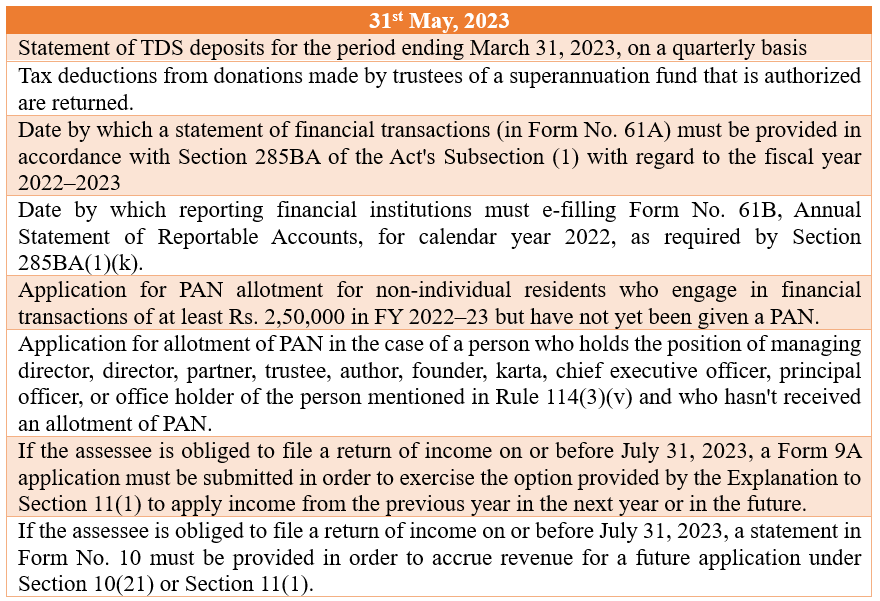

Taxpayers must be aware of important dates linked to taxes in order to avoid fines, manage their finances, submit their returns on time, and keep up with any changes in tax rules and regulations. Taxpayers may arrange their finances effectively and steer clear of any negative legal or financial repercussions by being aware of the deadlines for tax payments, including advance tax payments and self-assessment tax payments. Taxpayers can also save money by filing their taxes on time and avoiding fines and interest costs that can mount up rapidly. To properly comply with tax rules and regulations, it is also necessary to keep up with any changes in such laws and regulations. Overall, keeping track of important tax-related dates may help taxpayers manage their finances wisely, avoid financial and legal repercussions, and maintain compliance with tax rules. The following notable dates for the month of May are listed on the tax calendar found on the Income Tax Department’s official website.