Silver and gold are well-known for being secure investments. Their costs rise whenever there is a crisis. After the battle between Russia and Ukraine last year, their prices began to increase. The banking crisis and recession in the US and Switzerland increased demand when the war ended. The central banks’ repeated increases in interest rates as well as the high rate of inflation contributed to the rise in gold prices.

Since January of this year, gold and silver have surpassed all other instruments in terms of providing investors with benefits. The government’s modest savings program has provided more rewards than the stock market, together with bank FDs. Gold’s closing price on December 31st, 2022 was Rs 55,210 for 10 kilos. It was closed at Rs 60,930 this week, today. In other words, over this time, a return of around 12% has been obtained.

Glance on returns in this year

- Gold and Silver return up to 12%

- Interest on small savings schemes up to 8.20%

- Current interest on FD up to 9%

- 7% loss on investment in crude oil

According to analysts, this year will continue the pattern of rising interest rates, recession concerns, and high inflation. The cost of gold and silver will continue to be high in this circumstance. Gold and silver prices may rise to Rs. 65,000 and Rs. 85,000, respectively, by the end of this year. In terms of profit, both metals can exceed the market, FDs, and other instruments.

Silver and gold are still on the upward. Both of them broke a record on Friday after setting one on Thursday, last week. Gold increased by Rs 480 to close for the first price at Rs 61,780 per ten grams. Additionally, silver increased by Rs 410 to reach a new closing price of Rs 77,580. Gold had previously increased and finished at Rs 61,280 on Thursday. Silver also closed for the first time above 77,000. In international markets, the price of gold was $2,041 per ounce, while the price of silver was $25.88 per ounce. Both precious metals were rising in the Asian markets as a result. On the Comex, spot gold prices reached a 13-month high.

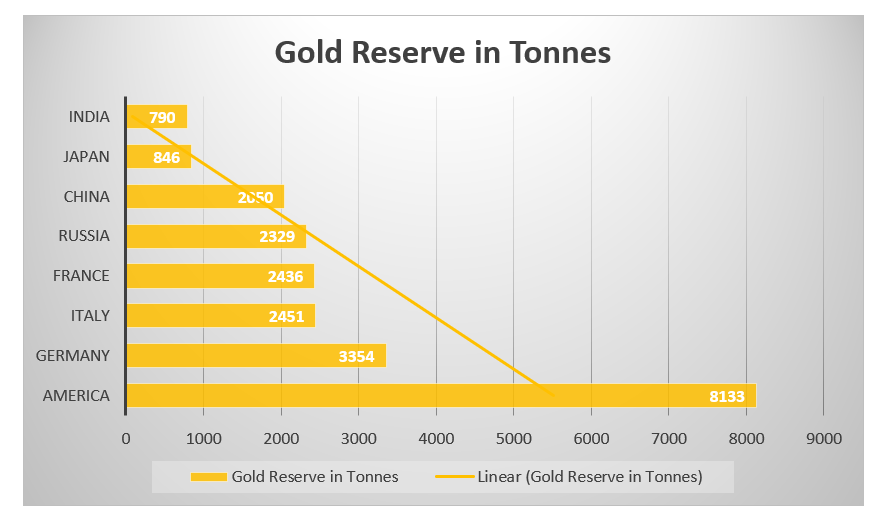

By the end of this year, the financial crisis is predicted to cause the economy to experience a recession, which might have an effect on the following two years. The US central bank’s dovish position on monetary policy is bolstering gold prices. Just take a look at the gold reserves held by central banks worldwide.