For the fiscal year 2023–2024, Finance Minister Nirmala Sitharaman unveiled a budget of ₹ 45.03 Lakh Crore. To estimate revenue and expenses, a budget is created. It’s distinct from an account, which records monetary transactions. The budget is a crucial component of every country’s economy since it aids in planning and managing its financial concerns. Recognize the specifics of the budget’s use of the funds, including where they will come from.

Components Of A Budget

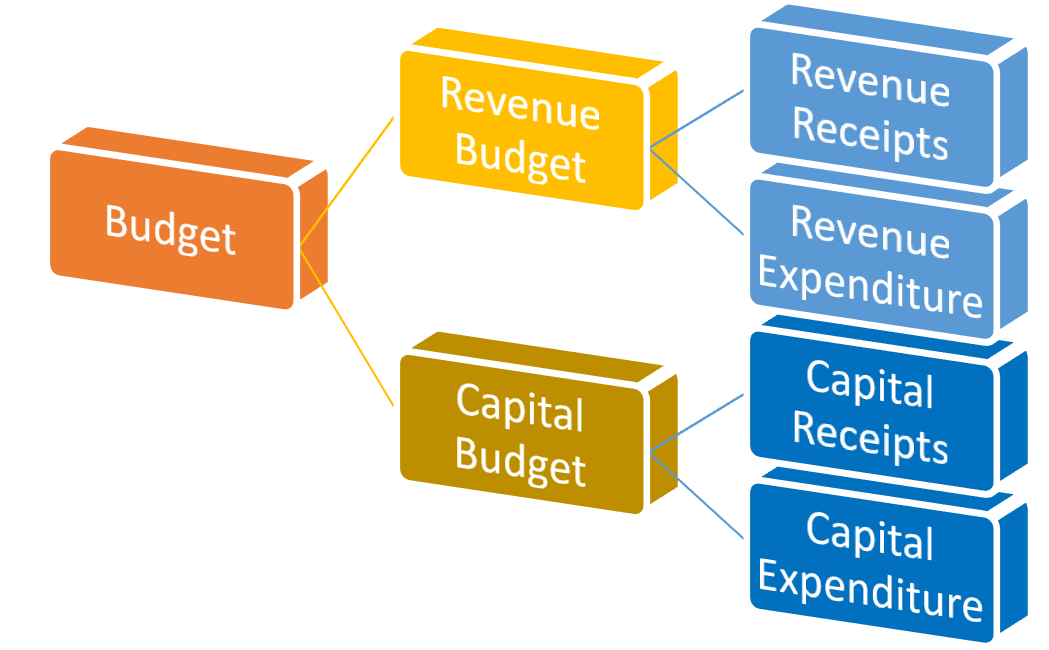

The primary parts of a government budget are two:

- Revenue Receipts: This part of the budget component includes the funds that the government receives through taxes (excise tax, income tax, etc.) and other non-tax sources (such as dividend income, earnings, interest revenues, etc.). The government’s assets and liabilities are unaffected directly by the revenue collections.

- Capital Receipts: A capital receipt is any payment that shows a decline in the government’s assets and a rise in its liabilities. Some examples are money that states get in return for repaying their debts and money received via disinvestments such as the sale of public company shares.

- Revenue Expenditure: Revenue expenditures are costs that don’t immediately affect the government’s assets and liabilities. Pensions, wages, office costs, and interest payments are a few examples of this kind of spending.

- Capital Expenditure: This investment is made to increase assets and decrease liabilities. Examples include the government lending money to states in the form of loans for the purpose of spending or making long-term investments in the construction of assets like hospitals, roads, etc.

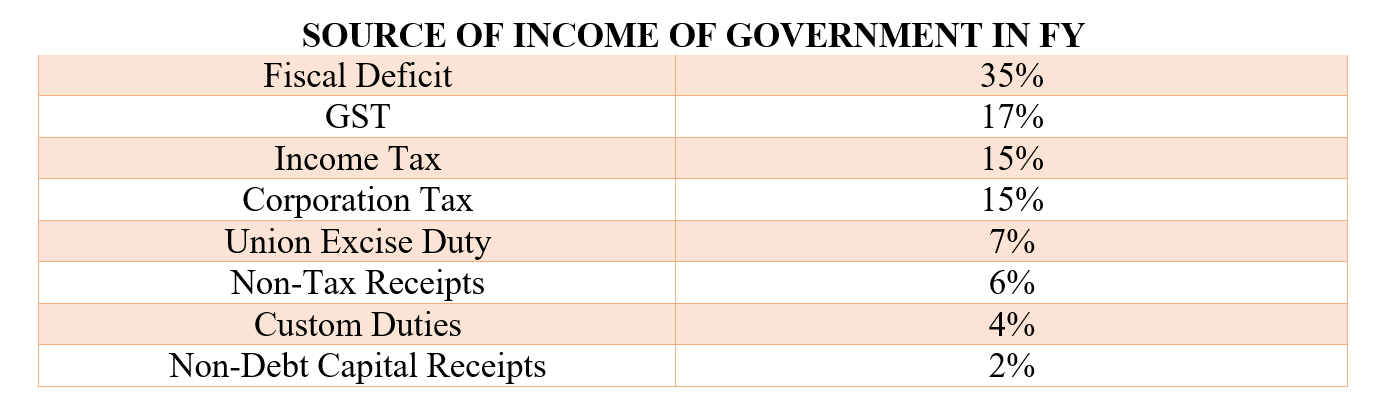

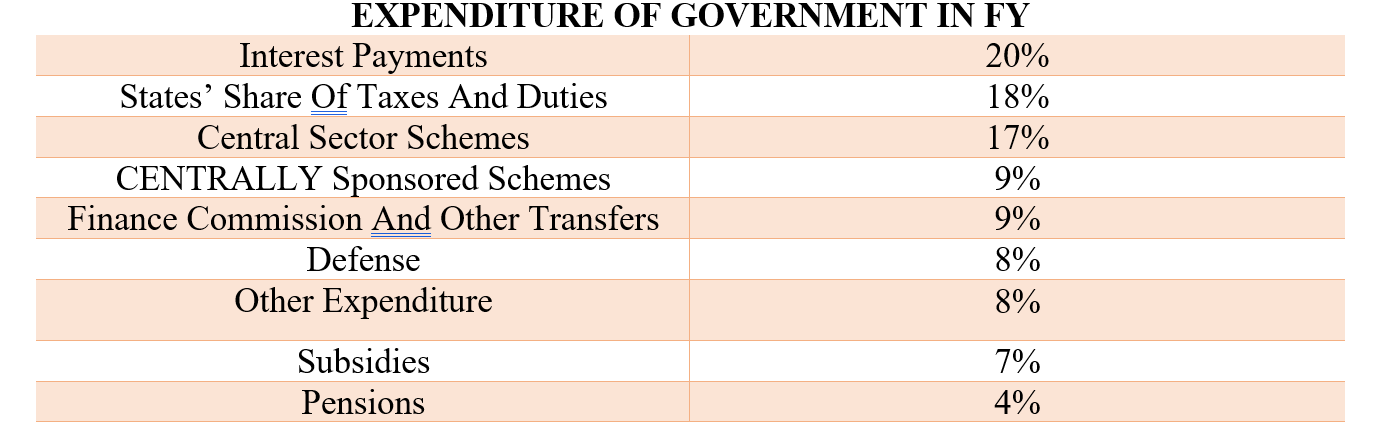

The following tables are showing from where the funds are coming and going to: –