The budget was announced on February 1, 2023, for the fiscal year 2023–2024. It may be claimed that the old tax regime has not changed if we are talking about any tax-related changes. However, this budget will provide varying levels of benefit to both seniors and paid workers. No taxes would be assessed on income up to ₹ 7,00,000, per the budget for 2023–24.

Let’s Have A Look At How Income Tax Will Be Computed In the Coming Financial Year.

- The new tax system should be set up by default, according to the finance minister. This only implies that you will switch to the new income tax regime automatically if you do not select the option while filling out your income tax return. The default tax scheme is still in place right now. A decision needs to be taken in order to select a new system. Although the new tax system is being supported by the government, individuals who do not save anything will benefit from it.

- No tax will be levied if your total annual income is up to ₹ 7,00,000, but there will be no benefit of any other type of savings discount.

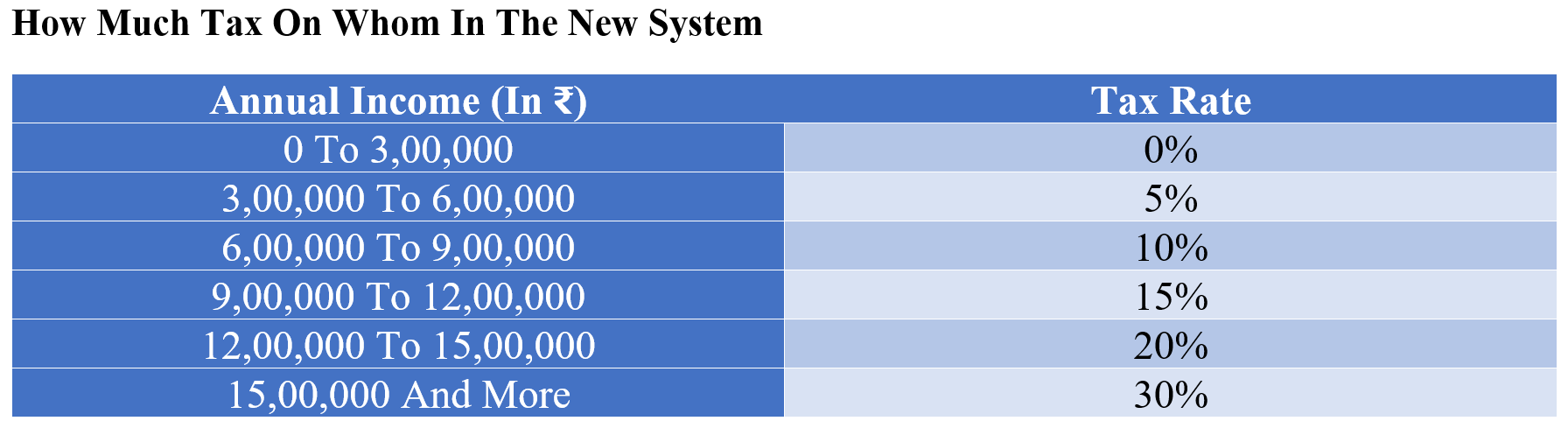

- Tax slabs will be applicable if the total income exceeds ₹ 7,00,000. Income up to ₹ 3,00,000 will be tax-free. ₹ 3,00,000 to ₹ 6,00,000 will have to pay a 5% tax.

- Salary holders will get the benefit of a standard deduction of ₹ 50,000, pensioners will get ₹ 15,000. This budget will benefit only those who are earning more than ₹ 15,50,000.

- Apart from this, for the first time under the new tax system, the benefit of a standard deduction of ₹ 50,000 will also be given.

- Apart from this, relief has also been given in the budget to taxpayers with a personal income of more than ₹ 2 Crore. In this, the highest rate of surcharge has been reduced from 37% to 25%. This will result in a saving of about ₹ 20,00,000 for a person with a salary of about ₹ 5 Crore.

- The union budget has also proposed to introduce a next-generation uniform IT Return form for the convenience of taxpayers. Along with this, it has also been announced to deploy about 100 Joint Commissioners for the disposal of small appeals in matters related to direct tax. The department will adopt a selective approach in the matter of the security of returns.

Will Get Benefit Of… In New Tax Regime

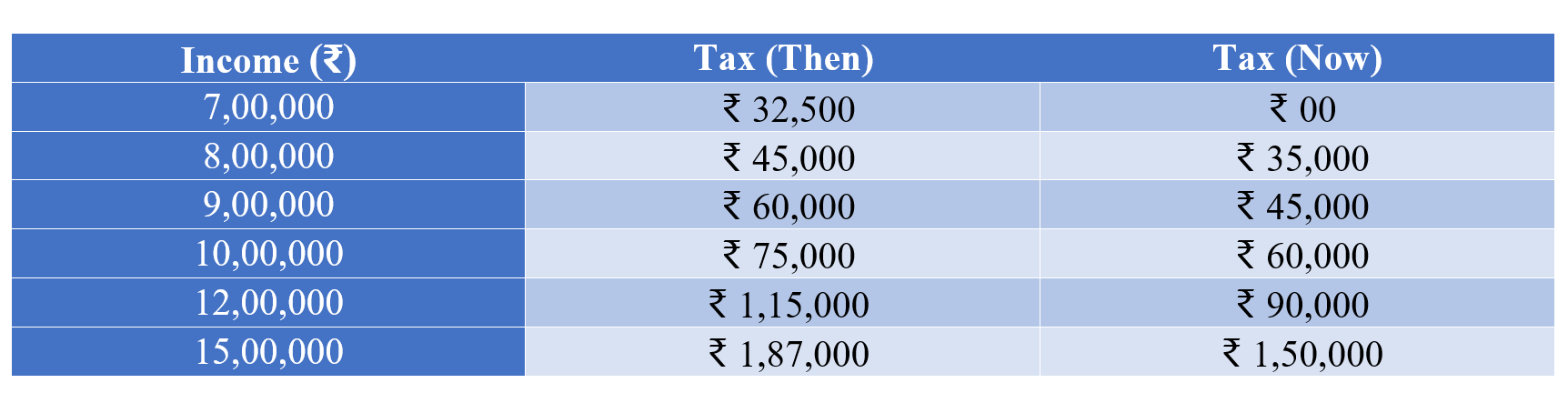

In the new tax regime, a person earning up to ₹ 7,00,000 will save ₹ 33,800 annually. ₹ 23,400 on income up to ₹ 10,00,000 and ₹ 49,400 will be saved on income up to ₹ 15,00,000 and so on.