In order to reach the tax collection target established for FY2023 and enhance total revenue collection, the Central Board of Direct Taxes (CBDT) urges tax officers to give cash collection from arrears and tax demand more attention.

The Central Board of Direct Taxes (CBDT) has instructed tax officials to speed up the recovery of unpaid tax following its meeting on December 21st. The officers have been instructed to hasten the resolution of open cases having large tax demands. The tax that was due to the taxpayers but hasn’t been paid is referred to as arrear tax demand.

However, consider historical tendencies. Thus, fewer than 10% of the due tax has been recovered yearly during the past few years. The arrears are continually growing due to lawsuits, company liquidations, untraceable taxpayers, and variations in tax withholding at the source. Due to stay orders issued by courts or tribunals, recovery wasn’t even feasible in some instances.

In April 2022, the total amount still owing climbed by 25% to ₹ 19 Lakh Crores. This sum was ₹ 15 Lakh Crores a year ago. We have discovered that the CDBT has voiced worry over the rise in legal actions and the associated income losses.

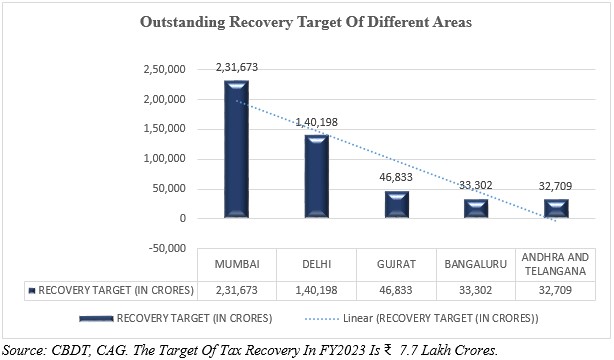

A decision to further up efforts by the tax department to recover unpaid taxes was made at a CBDT meeting. The tax administration has increased efforts to collect ₹ 2.05 Lakh Crores in cash and recoup roughly 40% of the outstanding tax demand in the remaining months of the current fiscal year. The agency set a goal of collecting ₹ 7.7 Lakh Crores in tax arrears during the current fiscal year.

The CBDT addressed the reasons why tax collection is challenging at the meeting and came up with a detailed road plan for clearing the bottlenecks in a timely way. Additionally, recovery notices will be delivered to several organizations and individual taxpayers nationwide.

The action is perceived as an effort to raise the most money possible before the general budget. The instruction comes at a time when the Center, despite exceeding its expenditure obligations, has decided to keep the budget deficit in the current fiscal year to 6.4% of GDP.

The Parliamentary Standing Committee on Finance voiced worry about bad debts in the area of direct and indirect taxes during the monsoon session of Parliament last year. The committee has recommended administrative and legislative measures to open the door for the collection of tax debts.