In FY2023, India’s pharmaceutical exports may reach a new high of ₹ 2700 Crore Dollars. The Pharmaceuticals Exports Promotion Council (Pharmexcil) top official predicted that it will be the highest-valued export ever. The new Covid regulations in China will also aid in accomplishing this goal. China is ready to soften its Covid regulations, which is why the last day saw a spike in the Sensex. Due to widespread purchasing domestically by investors who were optimistic about the state of the world economy following the relaxation of Covid regulations for tourists to China, both the main indexes Sensex and nifty rose for the second straight day today.

The national health commission of China announced on Tuesday that beginning on January 8th, it will not quarantine visitors. As a result, there was a boom in the international markets, which had an impact on the domestic stock market as well. At the closing of trade, the Sensex had gained 361.01 points, or 0.60%, and was trading at 60,927.43. Opening the international gates will also lead to an increase in the export of pharmaceutical items worldwide. This announcement may lead to an increase in the cases of Corona Virus, which can be one of the reasons for this.

India has seen the most success in past years in developing a corona virus vaccine as well as other treatments for infection-related illnesses. This has caused the market for Indian pharmaceutical businesses to grow. It is the finding that the pharmaceutical industry’s market will not be adversely affected by the impending recession. If we look at the past year’s performance of pharmaceuticals, India exported pharmaceutical items of ₹ 2,462 Crore Dollars in FY2022. From April to November of this year, India exported pharmaceutical items valued at ₹ 1,657 Crore Dollars.

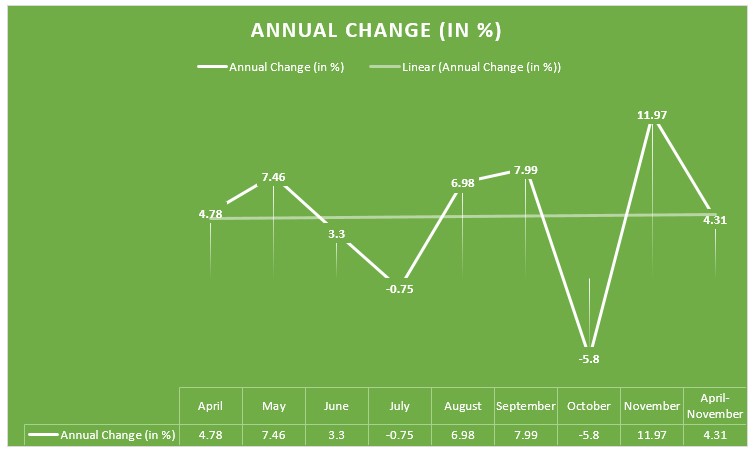

When compared to the same period last year, India’s exports are up 4.3% this year. In contrast, November of this year experienced a significant increase of 12% in comparison to November of the previous year. Even at the monthly pace, the financial year has witnessed a gain of 5.4%.

The fiscal increase of 4.3% between April and November, according to Uday Bhaskar, Director of Pharmexcil, is far better than the overall state of the world economy. Bhaskar predicted that in the upcoming months, the growth rate will improve. The months of January through March are typically seen to be the best ones for exporting pharmaceutical goods. It is anticipated that the 7%-8% growth each month would continue for the following three months after the end of the holiday season in December.

India can achieve total exports of 2700 Crore Dollars in this fiscal year. The majority of India’s exports during this fiscal year have gone to European nations. The total exports to European countries were 14.19% while the total exports to America, Canada, and Mexico were 67.5%. Exports to West Asia and North Africa were the greatest followed by European nations. There were 12.68% of all exports to these nations. 51% of all exports went to Europe and America last year, and additional shipments are anticipated from these regions this fiscal year.

This is a result of this period’s improved exports to Europe. This estimate is also accepted by experts. The demand from Europe is still increasing, and inventory positions are also lessening. Exports to Africa have witnessed a modest decline, as far as exports are concerned. Pharmexcil data show that exports to America increased by 1.6% during the current fiscal year. The exports from South Asia were the worst. Between April and November, shipments decreased by 15%. The majority of purchases in Africa are made via NGOs, particularly for COVID-19 and other anti-infective drugs. The dollar is strengthening in African nations while the export rate has declined significantly, both of which have a negative impact on the continent’s economic status. According to a senior executive of a company with its headquarters in Gujarat, the pharmaceutical company also thinks that Nigeria is the finest market in Africa and that because India’s currency there is depreciating against the dollar, the country has curtailed its imports.