The Indian stock market has recently witnessed volatility, causing many benchmark indices to fluctuate and even decline. However, investors in Mutual Funds (MFs) have remained resilient. This period of uncertainty has not deterred fund managers or retail investors from infusing substantial capital into both equity and SIP-based schemes. Mutual funds, contrary to expectations, have shown consistent inflows despite the bearish sentiment in the markets.

Market Trends and the Rise of MF Investments

Over the past few months, market fluctuations have intensified. The Nifty and Sensex indices saw significant corrections. For instance, since September 27, these benchmarks have experienced steady declines, dropping nearly 7%. The period between September 26 and October 21 has also seen the indices fall for seven consecutive sessions—contributing to the concern among individual investors.

Despite these corrections, mutual fund investors have exhibited a contrary behavior, continuing to inject capital through systematic investment plans (SIPs). According to industry experts, the equity market’s drop has created new opportunities, encouraging disciplined investors to accumulate more units at lower prices.

Robust Mutual Fund Investments in Equity Schemes

Even in this challenging environment, investments through SIPs have remained strong. The mutual fund industry recorded significant inflows, especially in the small-cap and mid-cap segments, which received about ₹7,000 crore during this period. Additionally, flexi-cap funds saw robust inflows amounting to approximately ₹4,000 crore.

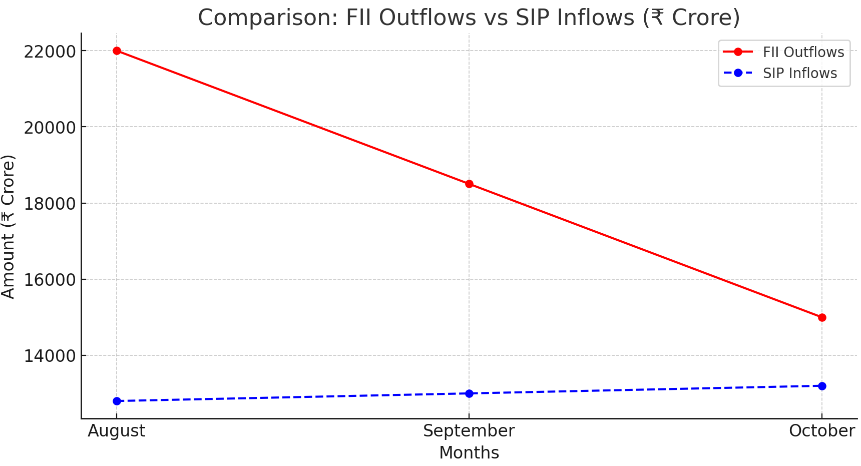

In terms of foreign institutional investors (FIIs), outflows have persisted as they reposition their portfolios due to international market trends and interest rate concerns. However, domestic investors have stepped in to fill this void, offsetting the selling pressure from FIIs.

SIP Momentum Continues Unabated

As per recent data, investors have purchased shares worth ₹66,000 crore in the past three months alone, showcasing the trust retail investors have placed in SIPs and other mutual fund products. The surge in investments has been particularly noticeable in ELSS (Equity Linked Savings Schemes), which offer both tax benefits and long-term growth potential.

Given the prevailing market dynamics, experts recommend maintaining a systematic approach to investing, particularly through SIPs, which helps investors average out costs over time. The SIP inflows, which have become a cornerstone of retail investment in India, also reflect the growing financial awareness among individual investors.

Outlook: Should Investors Worry?

The resilient performance of mutual funds in a bearish market has highlighted the importance of disciplined investment. While external factors such as geopolitical tensions and FII outflows may temporarily impact the market, long-term investors stand to benefit by staying committed to their financial plans.

With 2 million new investors entering the mutual fund space in the last quarter alone, the AUM (Assets Under Management) has grown steadily. The industry’s total AUM is expected to exceed ₹50 lakh crore by early 2024, compared to ₹48 lakh crore in August 2024—indicating a growing preference for professional fund management among Indian investors.

SIPs as the Way Forward

In summary, mutual funds in India have emerged as a popular investment avenue, despite market volatility. SIPs, in particular, remain a preferred choice, helping investors manage risk and take advantage of market dips. Investors are advised to stay focused on long-term goals and avoid panic-selling during downturns.

With a structured and patient approach, mutual fund investments are well-positioned to deliver robust returns in the coming years. As experts recommend, staying invested during challenging phases often provides the best rewards for disciplined investors.