The Indian stock market has seen notable changes recently, characterized by a decline in cash market transactions. Despite this, the overall trading activity hasn’t slowed down; instead, there’s been a shift toward derivatives trading. This blog explores the latest trends in the market and the factors driving these changes.

Market Dynamics: A Shift from Cash to Derivatives

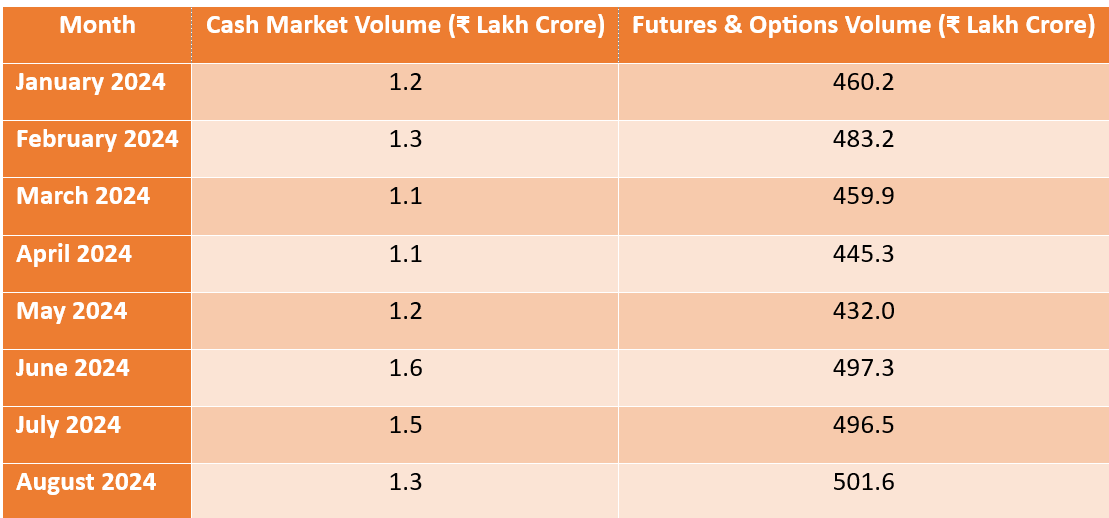

Over recent months, the cash market trading volume has consistently declined due to concerns over high valuations. The average daily trading volume in the cash market decreased from ₹1.2 lakh crore in January 2024 to ₹1.3 lakh crore in August 2024. Meanwhile, the derivative trading segment, particularly Futures and Options (F&O), has shown consistent growth, increasing from ₹460.2 lakh crore in January 2024 to ₹501.6 lakh crore in August 2024.

Key Trends and Data Insights:

The table below illustrates the changes in trading volumes over the past eight months:

Analysis of Trends:

The data reveals several key patterns:

- Decline in Cash Market Activity: The cash market’s average daily trading volume has shown a slight decline over the months, reflecting a cautious stance among investors due to concerns about high valuations.

- Increase in Derivatives Trading: On the other hand, the derivatives market, particularly F&O, has experienced a steady increase. June 2024 saw a significant rise in derivative trading volume to ₹497.3 lakh crore, which further increased to ₹501.6 lakh crore by August 2024. This trend indicates that investors are increasingly turning to derivatives for hedging and speculative purposes, responding to market volatility and valuation concerns.

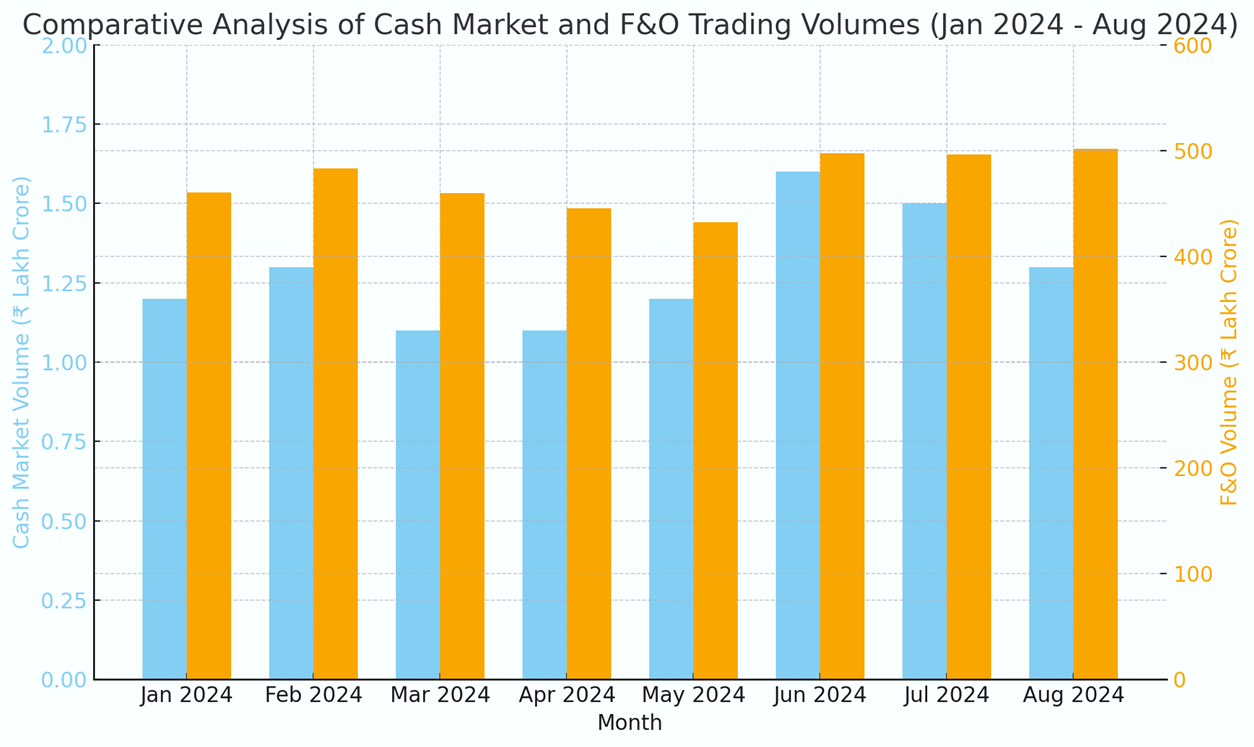

Comparative Analysis of Cash Market and F&O Trading Volumes

Below is a bar chart representing the comparative trading volumes for both the cash market and the F&O market from January to August 2024:

Key Observations:

- Cash Market Volume: The volumes range between 1.1 and 1.6 lakh crore rupees, showing minor fluctuations over the months.

- F&O Volume: The volumes are significantly higher, ranging from around 430 to over 500 lakh crore rupees, with an increasing trend, especially from June 2024 onwards.

The contrasting trends between the cash market and derivatives trading reflect a significant shift in investor behavior. While concerns over high valuations have dampened cash market activities, the growth in derivatives trading shows a preference for using advanced financial instruments for risk management and speculation. This trend underscores the dynamic nature of the financial markets, where participants continuously adapt to changing conditions.